Are you wondering when you will be able to recoup your market losses?

So far, 2022 has been an odd year. It almost feels like the lethargy that comes after a marathon's endorphin high (we thought we'd capitalize on the upcoming NYC marathon with this analogy!). How so?

Investors were on a literal high at the start of this year, with peak returns following the remarkable recovery from the initial pandemic lockdowns. However, as the economy and stock market continued to deteriorate, lethargy set in. Unfortunately, that is not the only thing going on. The Ukraine/Russia conflict, tensions surrounding China and Taiwan, problems in the United Kingdom, and other factors continue to raise geopolitical risks. And we've all heard about the resurgence of inflation. Even in the NFL, greats like Tom Brady and Aaron Rodgers are struggling, while the predicted "lowly" New York teams are among the elite teams posting winning records! What's going on?

Might have a solution. No, we're not here to analyze the Buccaneers and Packers' problems (or to speculate on whether the Giants and Jets will finish strong) or to speculate on how geopolitical tensions might play out. However, can offer our thoughts on the stock market and your money.

The most frequently asked question among investors is, "When will I recover my market losses?"

First, no one knows when the market will turn or what the future return trajectory will look like. The market frequently drops but quickly recovers. That is true in any given year. However, in order to gain insight into deep drawdowns and loss recovery, we examined previous market drops. Here's what we discovered:

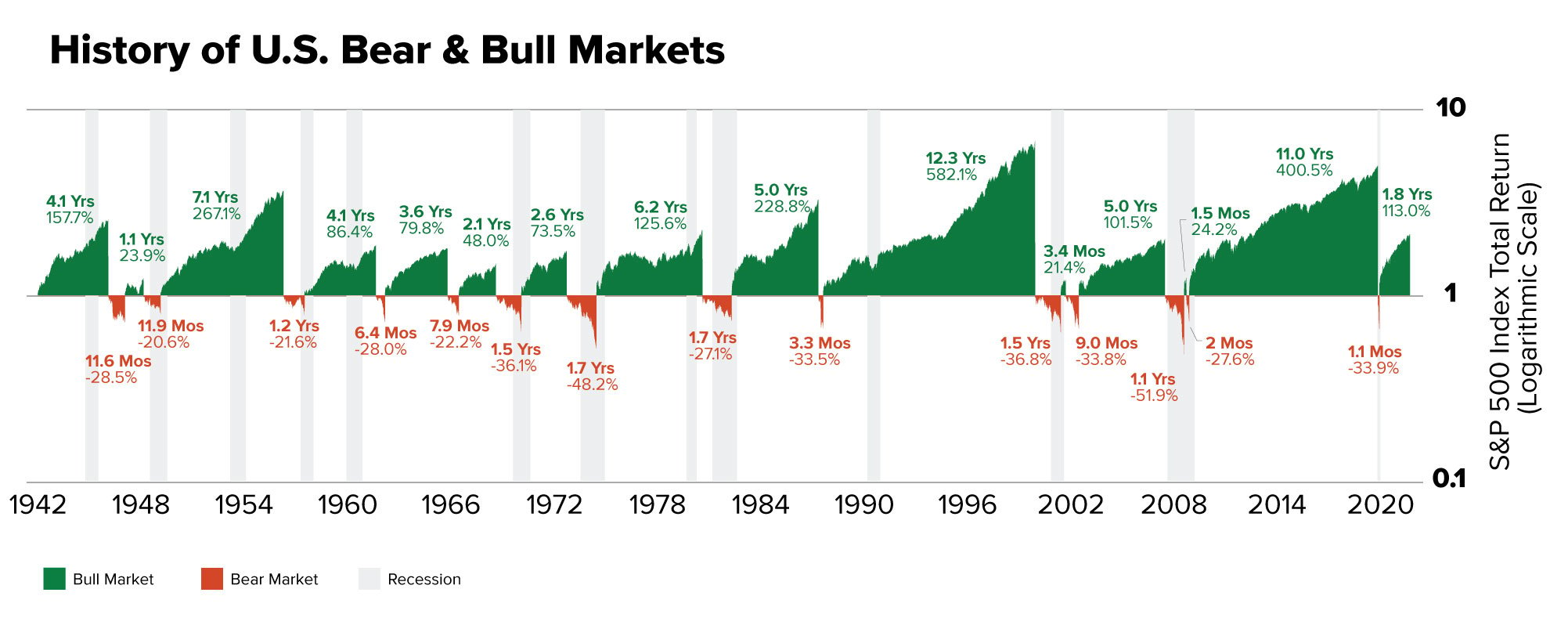

Between 1942 and 2021, the US stock market experienced 14 bear markets in which it fell by at least 20%. The S&P 500 has dropped 25% in the first three quarters of 2022, putting it firmly in bear territory.

Fortunately, there is some good news that helps keep some investors sane during bear markets. Data spanning nearly eight decades show that historically, up markets last longer, occur more frequently, and deliver higher returns than down markets.

• From 1942 to 2021, the average bull market (green) lasted 52.8 months and returned 155.6%.

• From 1942 to 2021, the average bear market (red) lasted 11.3 months and resulted in a 32.1% loss.

Bloomberg cites First Trust Advisors L.P. as the source. Daily returns between 4/29/1942 and 12/31/2021. Past results are no guarantee of future outcomes. These results are based on daily returns; returns calculated over different time periods would yield different results. This chart is only for illustration purposes.

Let's emphasize that once more: Bull markets lasted 41.5 months longer and delivered a 123.5% higher cumulative total return than bear markets on average over the 79 years studied.

We hope this brings some solace to those of you who have the time to wait for a recovery and the ability to bear the current losses. However, We understand that some of you may be concerned because time may not be on your side. For example, if you rely on your investments to fund your retirement or plan to purchase a home next year, you may be concerned about recovering your losses before you run out of money or make your purchase.

Historically, how long did it take to recover from a loss?

We must perform some relatively complex investment math to determine how long it has historically taken to recover market losses. We'll spare you the calculations, but suffice it to say that in order to recover losses, the market must gain more than it lost. In other words, if the market loses 10%, it must earn 11% to compensate. Alternatively, if the market drops 30%, it will require 43% to break even.

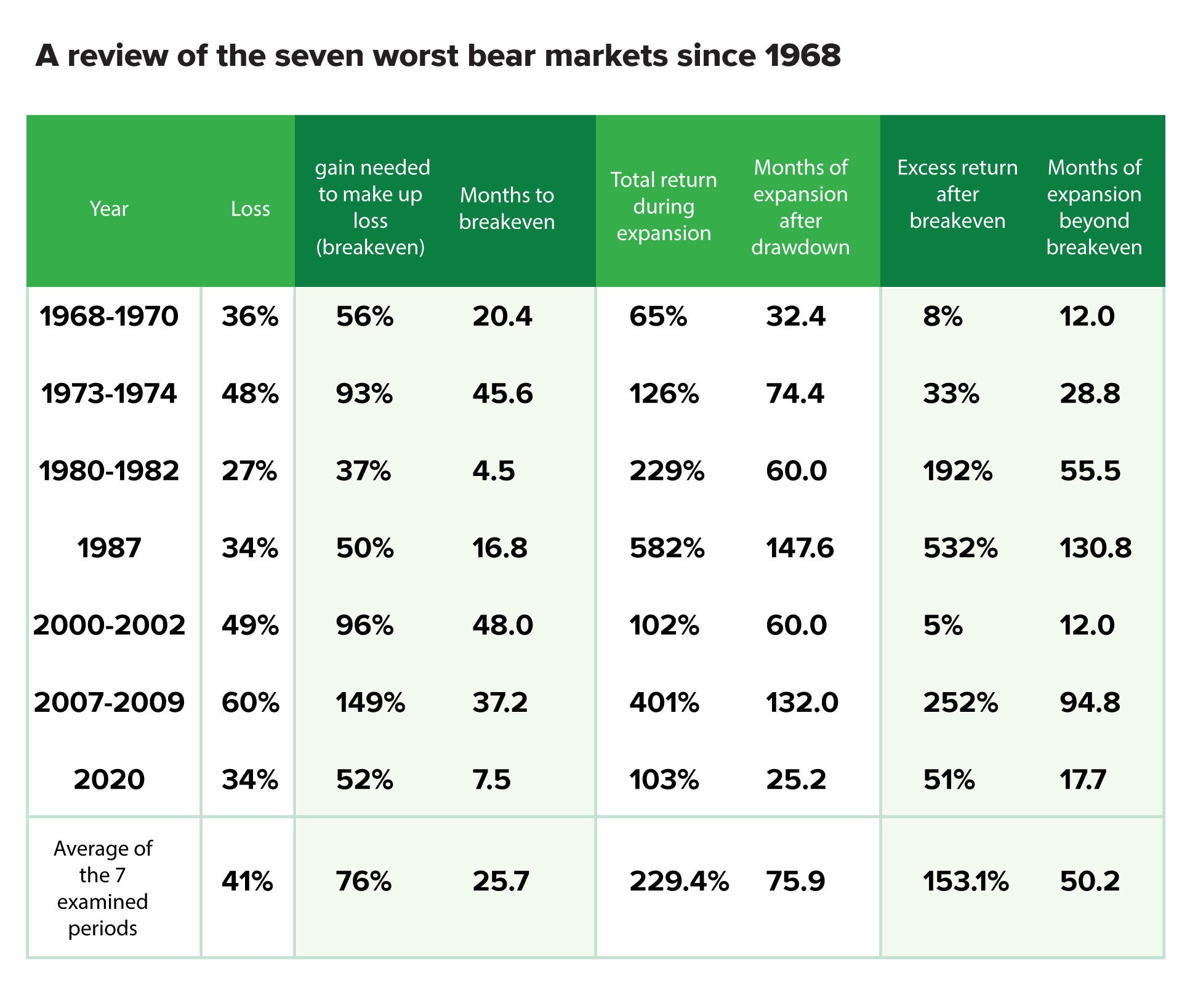

Instead of evaluating all bear markets, we chose to examine seven of the worst bear markets in the modern stock market era to gain perspective on the average time it has taken to recover steep market losses. Some of these time periods, from 1968 to 2021, are comparable to today's environment. For example, the years 1973-1974 and 1980-1982 can shed light on similar economic conditions, whereas the years 2000-2002 and 2007-2009 describe asset bubbles.

Data sources: FirstTrust and Yahoo Finance.

The most important takeaway from this data is that during the worst bear markets since 1968, stocks fell 41% on average. The average gain required to compensate for those losses was 76%. It took the market just over two years on average to recover those losses, and the market continued to grow for another four years, gaining another 153% on average.

In today's terms

As previously stated, the S&P 500 has fallen 25% this year.

So, based on that percentage, it must increase by 33% to compensate for the loss. How long could that possibly take?

To answer the question, we could compare the current economy and market loss to previous periods. We cannot draw a precise comparison because no period exactly reflects today's market or economy, but we can show periods with similar factors and their loss recovery time frames.

• Today's rising inflation, interest rates, and slowing growth are comparable to the periods 1973-1974 and 1980-1982. However, the labor market is strong in comparison to the high unemployment of the past. The 1980s market decline is most similar to today's. While this is not an apples-to-apples comparison, we can see that it only took 4.5 months to make up the difference. The 1970s drawdown, on the other hand, was more severe, and it took nearly four years to climb out of it.

• Some investors believe we are in a real estate bubble as a result of the significant rise in home prices combined with mortgage rates that have risen to 20-year highs. However, unlike during the 2007-2009 financial crisis, we believe financial institutions' balance sheets are stronger today, and better homebuyer vetting should reduce the likelihood of mortgage defaults.

The last word

We recognize that we did not provide a definitive answer as to how long it takes to recover your losses. This is due to the fact that no one knows. Past performance is not always an indicator or a guarantee of future results. However, previous experiences provide three critical takeaways:

#1: In the past, the market has recovered from every downturn, including steep and prolonged declines. And it had continued to grow despite the losses.

#2: It has taken less than two and a half years on average to recover market losses when severe declines occurred during the worst bear markets.

#3: Investors who sell out of the market and do not reinvest may not be able to recoup losses.

There is one more critical piece to this puzzle. We believe you will recover your losses faster if you continue to save money in your retirement or other investment accounts during this downturn. How? Because you'll be purchasing shares at low prices, you'll be starting from a lower base when the market rises.

We understand—this is the polar opposite of what your gut is telling you to do. (We truly understand because we are investors, and our retirement accounts, children's college funds, and other investments are all declining.) However, if you have the time and money to invest, we believe your long-term growth will be higher. If you don't have the time because you need your investments to cover your daily expenses, try to supplement your retirement income with other sources right now.

The current market also serves as a reminder that if you rely on your investment savings to cover your living expenses, you should have a rainy-day fund on hand. We recommend setting aside two to three years of living expenses from your investment fund for a cash fund. You won't have to sell your investments during a downturn, thereby locking in market losses.

Contact me at [email protected]

Check out our website at www.retirewisepro.com

#RetireHappy #retirementplanning #retirementincome